Utilizing methods just like the straight-line method and contemplating elements similar to asset situation and market demand, companies could make informed decisions about asset disposal and alternative. This complete strategy ensures efficient financial management and optimized useful resource allocation. Guide worth (also often recognized as web book value) is the whole estimated worth that would be received by shareholders in an organization if it were to be sold or liquidated at a given moment in time. Web book value can be very helpful in evaluating a company’s income or losses over a given time period. The present worth of money move after taxes could be calculated to resolve whether or not or not an investment in a enterprise is worthwhile. The greater the CFAT, the higher positioned a enterprise is to make distributions to buyers.

Instance Of Salvage Worth Calculation For A Automotive Belonging To A Business For After And Earlier Than Tax

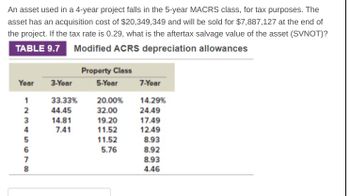

In this article, we’ll stroll you thru the process of calculating the after tax salvage value. The after-tax salvage worth is the net worth of an asset after it has been bought and all associated taxes have been deducted. It is a critical element in assessing the profitability of an funding and the monetary influence of disposing of an asset. Salvage value is a concept that holds vital significance on the planet of business. This value performs an important function in monetary decision-making because it affects numerous elements such as depreciation, asset disposal, and capital budgeting.

Once you’ve decided the asset’s salvage worth https://www.personal-accounting.org/, you’re able to calculate depreciation. It can be calculated if we are able to decide the depreciation rate and the helpful life. For tax purposes, the depreciation is calculated in the US by assuming the scrap worth as zero.

Salvage value is a vital the after tax salvage value is calculated as sv t concept in accounting that determines the value of an asset on the finish of its helpful life. A salvage worth of 40% of the preliminary value of a automobile is a standard example, where $4000 is the salvage value. There may be somewhat nuisance as scrap value could assume the great just isn’t being offered but as an alternative being converted to a uncooked materials. For example, a company could resolve it wants to just scrap a company fleet automobile for $1,000. This $1,000 may be thought of the salvage worth, although scrap value is barely more descriptive of how the corporate could dispose of the asset.

Closing Entries Defined: Key Steps & Examples

To qualify for depreciation, an asset must be owned by your small business and utilized in a business or income-producing activity. The worth of an asset can change over time due to factors like age, condition, rarity, obsolescence, put on and tear, and market demand. To calculate salvage value, you have to know the asset’s helpful life and its original cost.

Instance And Method

- It is actually the web cash influx or outflow resulting from the final section of a project or funding.

- The double-declining stability (DDB) method uses a depreciation price that’s twice the rate of straight-line depreciation.

- It should be noted that the value of the asset is recorded on the company’s balance sheet whereas the depreciation quantity is recorded in the revenue statement.

- This implies that the computer might be used by Firm A for four years and then bought afterward.

- Depreciation measures an asset’s gradual loss of value over its useful life, measuring how much of the asset’s preliminary value has eroded over time.

- The four depreciation methods available are straight-line, units of manufacturing, declining stability, and sum-of-the-years’ digits.

It’s the estimated worth of one thing, like a machine or a automobile, when it’s all worn out and in a position to be bought. This differs from guide value, which is the value written on a company’s papers, contemplating how a lot it’s been used up. It’s essential to accurately estimate the salvage worth to manage assets successfully and make knowledgeable financial decisions. Depreciation schedules provide an in depth record of how assets depreciate over time, ensuring correct financial reporting and compliance with accounting standards.

The liquidation value is the worth of a company’s actual estate, fixtures, gear, and inventory. In order to find an asset’s residual value, you have to additionally deduct the estimated costs of disposing the asset. If you earn capital positive aspects on the disposal of an asset, you’ll typically be required to pay tax on that quantity. In the case of capital losses, they can often offset other capital gains or be carried forward to offset future positive aspects.

This ensures a precise calculation of depreciation bills, which ultimately impacts the estimated salvage worth. It means that the asset might be depreciated sooner than with the straight line methodology. The double-declining balance methodology leads to larger depreciation expenses in the beginning of an asset’s life and lower depreciation bills later. This method is used with belongings that rapidly lose value early in their useful life. A company can also choose to go along with this method if it presents them tax or cash circulate benefits. Failing to account for depreciation recapture can result in an overestimation of the online proceeds from asset disposal and, consequently, inaccurate monetary projections.

The stage of maintenance and maintenance carried out on an asset throughout its lifespan can affect its salvage value. Correct upkeep and regular repairs might help protect an asset’s condition and performance, increasing its salvage value. On the other hand, uncared for or poorly maintained belongings could have a decreased salvage worth as a end result of their diminished situation.

From this, we know that a salvage worth is used for figuring out the value of an excellent, equipment, or maybe a company. It is beneficial to the buyers who can then use it to assess the right worth of an excellent. Depreciation measures an asset’s gradual loss of worth over its useful life, measuring how much of the asset’s preliminary value has eroded over time. For instance, in Instance three, the salvage value of engineering machinery costing INR a hundred,000 with a useful life of 7 years and annual depreciation of INR 10,000 is INR 30,000. The after-tax salvage worth formulation is a crucial software for companies to find out the worth of an asset after its helpful life.