In the world of Forex trading, understanding regulations is paramount for both novice and experienced investors. When discussing the regulatory landscape, one name often mentioned is Exness. As a trusted Forex broker, exness forex regulatory exnessreview.net provides comprehensive insights into how the Exness Forex regulatory framework operates. This article will delve into the key aspects of Exness Forex regulations, ensuring traders are well-informed about their rights and protections.

What is Forex Regulation?

Forex regulation refers to the legal framework established by authorities to govern the Forex trading market. Its primary purpose is to protect investors from fraudulent practices, ensuring the integrity and transparency of trading operations. In the Forex market, regulations often dictate how brokers operate, safeguarding the interests of both individual and institutional traders.

Why is Regulation Important?

The significance of regulation in Forex trading cannot be overstated. Here are a few reasons why it matters:

- Protection of Traders: Regulatory authorities impose strict guidelines that brokers must follow. This includes maintaining necessary capital reserves and providing a secure trading environment, thereby protecting traders’ funds.

- Transparency: Regulations help prevent fraudulent activities by ensuring brokers operate transparently. This includes clear reporting practices and adherence to set guidelines, enabling traders to make informed decisions.

- Dispute Resolution: In the event of a conflict, regulatory bodies provide mechanisms for dispute resolution, giving traders a platform to voice their concerns.

Exness: An Overview

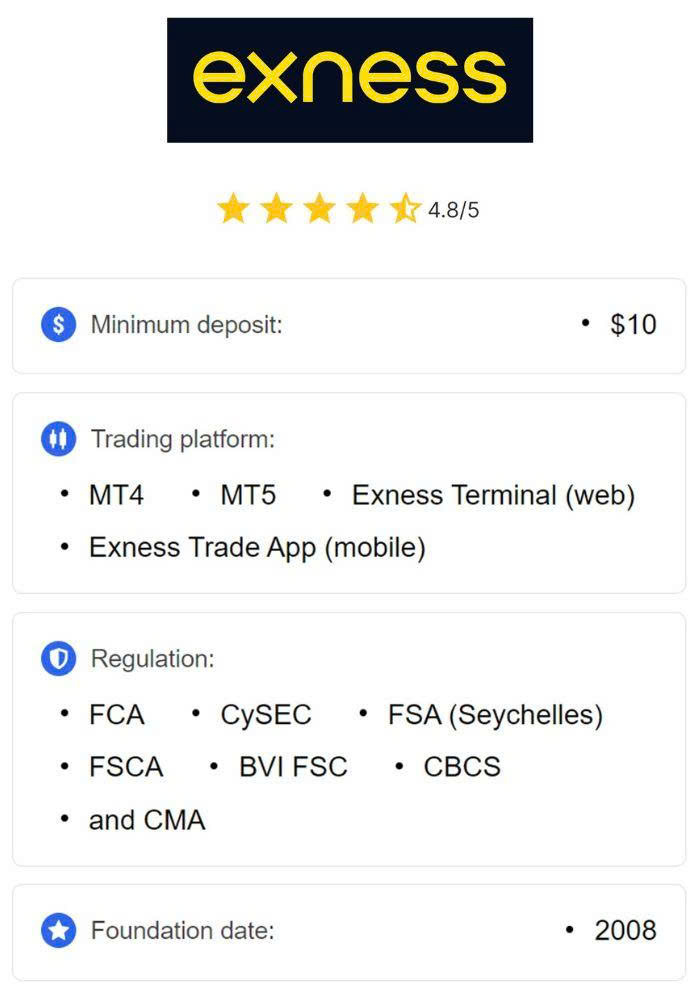

Exness was established in 2008 and has grown rapidly to become one of the leading Forex brokers worldwide. With a commitment to innovation and trader satisfaction, Exness provides multiple trading instruments, competitive spreads, and various account types. However, what truly sets Exness apart is its dedication to regulatory compliance.

Regulatory Authorities Governing Exness

Exness operates under the oversight of several regulatory authorities, which varies depending on the region. The most prominent regulators include:

- Financial Conduct Authority (FCA): Based in the UK, the FCA is known for its strict regulatory standards. Forex brokers regulated by the FCA must adhere to stringent financial practices, ensuring trader funds are protected up to £85,000.

- Cyprus Securities and Exchange Commission (CySEC): As a major regulatory body in the European Union, CySEC ensures that Exness complies with EU regulations, enhancing the broker’s credibility in the European market.

- Financial Services Commission (FSC) of the Republic of Mauritius: This regulator oversees Exness’s activities in various regions, ensuring they operate within legal boundaries and maintain high ethical standards.

How Exness Ensures Regulatory Compliance

Exness employs various strategies to remain compliant with regulatory standards:

- Segregation of Funds: Exness ensures that client funds are held in separate accounts from the company’s operational funds. This segregation minimizes the risk of mismanagement and ensures traders’ funds are available when required.

- Regular Audits: To maintain transparency and accountability, Exness undergoes regular audits conducted by independent firms, validating its operations adhere to regulatory standards.

- Reports to Regulatory Bodies: Exness is required to submit regular reports to its governing authorities, which include detailed activity accounts, ensuring ongoing compliance with regulatory obligations.

Benefits of Trading with a Regulated Broker

Choosing to trade with a regulated broker like Exness comes with numerous advantages:

- Increased Trust: Regulatory oversight gives traders confidence that they are trading with a trustworthy broker.

- Better Protection: In the event of insolvency or bankruptcy, regulatory frameworks often provide additional protection for traders’ funds.

- Access to Advanced Trading Tools: Regulated brokers typically provide advanced trading platforms, research tools, and better customer support.

Risks of Trading with Non-Regulated Brokers

While there are numerous regulated brokers in the market, there are also many non-regulated brokers that may pose risks to traders. Here are some potential dangers:

- Fraudulent Activities: Non-regulated brokers might engage in dishonest practices, such as manipulating prices or refusing to honor withdrawals.

- Lack of Transparency: Without regulatory oversight, non-regulated brokers may not provide clear information regarding fees, spreads, and trading conditions.

- No Dispute Resolution: In the event of a disagreement, traders with non-regulated brokers may have no recourse or means of addressing grievances.

Wrap-Up: Why Choose Exness?

For traders looking for a trustworthy and reliable Forex broker, Exness stands out due to its robust regulatory framework, commitment to transparency, and dedication to customer satisfaction. The various regulatory bodies overseeing Exness not only offer security to traders but also enhance the overall trading experience. By choosing a regulated broker like Exness, traders can focus on what really matters—their trading strategy and market analysis—knowing that their funds are secure and that they have the backing of credible regulatory authorities.

Conclusion

In the fast-paced world of Forex trading, being informed is crucial. Understanding the regulatory landscape surrounding brokers like Exness empowers traders to make informed choices, fostering a safer trading environment. By opting for a regulated broker, traders can enjoy a greater sense of security and trust, which is essential in the high-stakes environment of Forex trading.